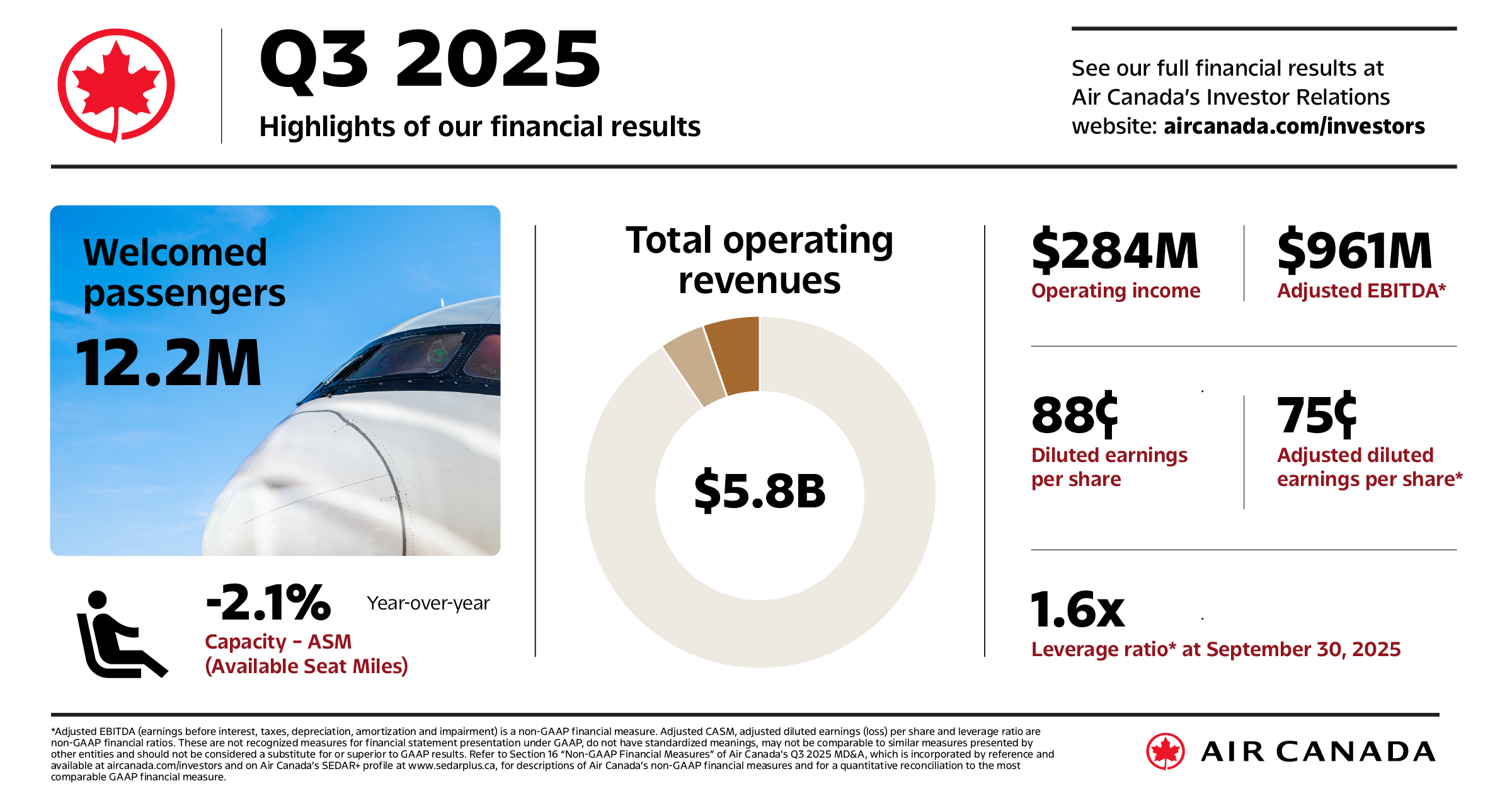

Air Canada Reports Third Quarter 2025 Financial Results

- Operating revenues of $5.774 billion, a decline of 5% versus last year

- Operating income of $284 million with operating margin of 4.9% and adjusted EBITDA* of $961 million with adjusted EBITDA margin* of 16.6%

- Net cash flows from operating activities of $813 million and free cash flow* of $211 million

- Robust momentum in bookings, positioning Air Canada to deliver solid results in the fourth quarter of 2025

MONTREAL, Nov. 04, 2025 (GLOBE NEWSWIRE) -- Air Canada today reported its third quarter 2025 financial results.

“We delivered a solid third quarter financial and operating performance, after adjusting for the labour disruption, which occurred at the peak of the summer season. We deeply regret that the disruption significantly affected our customers. The entire company worked extremely hard to assist those whose travel was disrupted and to quickly return our operations to normal, and we were also flexible with customer goodwill policies. I thank all employees for their commitment to customer service and operational excellence,” said Michael Rousseau, President and Chief Executive Officer of Air Canada.

“Our financial results, after adjusting for the strike impact, met our expectations, with strength in the Atlantic market and in our premium cabins. Operational metrics, such as on-time performance and net promoter score, exceeded both internal targets and last year’s levels for the quarter and year-to-date. Our underlying business fundamentals are very strong. There is good booking momentum in the fourth quarter and early positive indicators into the first quarter of 2026. Our trans-border business trends are largely stable and on par with the first half of 2025.

“We have exciting times ahead of us with growth plans fuelled by key strategic initiatives and new state-of-the-art efficient aircraft. Our focus over the next twelve months is on preparing the airline to grow and expand margins as we transform our fleet with the arrival of best-in-class aircraft across the portfolio and a revitalized Rouge offering. We will also continue to improve our cost structure through productivity gains, operational efficiencies and constant cost discipline to mitigate near term pressures. We continue to focus on free cash flow generation in order to return value to shareholders, including through the renewal of our share buyback program announced today. The hard work ahead in 2026 will position us very well for the second half of our strategic plan and to deliver significant long-term value to all stakeholders,” said Mr. Rousseau.

*Adjusted CASM, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), adjusted EBITDA margin, leverage ratio, net debt, adjusted pre-tax income (loss), adjusted net income (loss), adjusted earnings (loss) per share – diluted, and free cash flow are referred to in this news release. Such measures are non-GAAP financial measures, non-GAAP ratios, or supplementary financial measures, are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results. Refer to the "Non-GAAP Financial Measures" section of this news release for descriptions of these measures, and for a reconciliation of Air Canada non-GAAP measures used in this news release to the most comparable GAAP financial measure.

Third Quarter 2025 Financial Results

- Operating revenues of $5.774 billion

- Operating expenses of $5.490 billion

- Operating income of $284 million with an operating margin of 4.9% and adjusted EBITDA of $961 million with an adjusted EBITDA margin of 16.6%

- Income before income taxes of $511 million and adjusted pre-tax income of $329 million

- Net income of $264 million and diluted earnings per share of $0.88

- Adjusted net income of $223 million and adjusted earnings per diluted share of $0.75

- Adjusted CASM* of 13.99 cents

- Net cash flows from operating activities of $813 million and free cash flow of $211 million

Outlook

For the full year 2025, Air Canada is updating its guidance and major assumptions as previously provided on September 24, 2025. The updated full year 2025 guidance is as follows:

| Metric | Updated 2025 Guidance |

Prior 2025 Guidance (Provided on September 24, 2025 |

| Adjusted EBITDA | $2.95 billion to $3.05 billion | $2.9 billion to $3.1 billion |

| ASM capacity | About 0.75% increase versus 2024 | 0.5% to 1.5% increase versus 2024 |

| Adjusted CASM | 14.60 ¢ to 14.70 ¢ | 14.60 ¢ to 14.70 ¢ |

| Free cash flow | $0 to $200 million | -$50 million to $150 million |

Major Assumptions

Air Canada made assumptions in providing its guidance—including a marginal Canadian GDP growth for 2025. Air Canada assumes that the Canadian dollar will now trade, on average, at C$1.40 per U.S. dollar (previously C$1.39) for the full year 2025 and that the price of jet fuel will now average C$0.91 per litre (previously C$0.92) for the full year 2025.

Air Canada’s guidance constitutes forward-looking information within the meaning of applicable securities laws and is subject to important risks and uncertainties, including in relation to statements or actions by governments and uncertainty relating to the imposition of (or threats to impose) tariffs on Canadian exports or imports and their resulting impacts on the Canadian, North American and global economies and travel demand. Please see the discussion below under Caution Regarding Forward-looking Information.

Normal Course Issuer Bid

Air Canada is also announcing today that the Toronto Stock Exchange (“TSX”) has accepted notice of its intention to make a normal course issuer bid (“NCIB”) allowing it to purchase for cancellation up to 29,557,428 of its Class A variable voting shares and Class B voting shares (collectively the “Shares”) in accordance with the rules of the TSX.

Air Canada believes that the market price of its Shares from time to time may not fully reflect the underlying value of its business and future business prospects, and that purchases of Shares under the NCIB will allow it to continue addressing some of the shareholder dilution experienced from financing decisions necessary during the pandemic. In such circumstances, the purchase of Shares under the NCIB may be an attractive and appropriate use of its available cash, consistent with Air Canada’s priority of investing in its growth, maintaining balance sheet strength and generating shareholder value through a balanced capital allocation strategy.

Air Canada is authorized by the TSX to purchase up to 29,557,428 Shares under the NCIB, being about 10% of the public float of its Shares. As at October 24, 2025, the number of outstanding Shares totaled 296,202,861 of which 295,574,288 Shares represented the public float. Purchases under the NCIB are authorized during the period from November 7, 2025 to November 6, 2026. Decisions regarding the amount and timing of purchases of Shares will be based on market conditions, share price and other factors. Air Canada may elect to modify, suspend or discontinue the NCIB at any time.

Purchases will be made through open market transactions on the TSX or alternative Canadian trading systems, if eligible, or such other means as the securities regulatory authorities may allow, including block purchases, pre-arranged crosses or exempt offers, as well as private agreements under an issuer bid exemption order issued by a securities regulatory authority. Air Canada will pay the market price at the time of acquisition for any Share purchased, plus brokerage fees, or such other price as may be allowed. Any purchases made under an issuer bid exemption order would be at a discount to the prevailing market price of the Shares or otherwise in accordance with the terms of the order.

The average daily trading volume (“ADTV”) of the Shares on the TSX was 3,104,384 Shares for the six months period ended October 31, 2025. Under TSX rules, Air Canada may accordingly purchase up to 776,096 Shares on the TSX on any trading day, being 25% of the ADTV. Air Canada may also, once weekly, purchase a block of Shares not directly or indirectly owned by insiders, which may exceed such daily limit, in accordance with TSX rules. All Shares purchased pursuant to the NCIB will be cancelled.

Under its prior NCIB that commenced on November 5, 2024 and ended on November 4, 2025, Air Canada was authorized to purchase for cancellation up to 35,783,842 Shares, representing about 10% of Air Canada's public float as of October 22, 2024. Air Canada purchased the full amount of Shares authorized under the prior NCIB, at a weighted average price of $22.34. All such Shares were purchased through the facilities of the TSX or alternative Canadian trading systems.

Air Canada will enter into an automatic share purchase plan (the “Plan”) with its designated broker under which it may, but is not required to, instruct the broker to make purchases at times when it would ordinarily not be active in the market due to regulatory restrictions, self-imposed blackout periods or otherwise. Purchases by the designated broker made under the Plan, if any, will be based on parameters established by Air Canada in accordance with the rules of the TSX, applicable securities laws and the terms of the Plan. Shares may in Air Canada’s discretion be purchased under the NCIB outside of the self-imposed black-out or other restricted periods in compliance with the rules of the TSX and applicable securities laws.

2028 Targets and 2030 aspirations

On December 17, 2024, Air Canada announced its long-term 2028 financial targets and 2030 aspirations described below:

| Metric | 2028 Targets | 2030 Aspirations |

| Operating revenues | Approximately $30 billion | Exceed $30 billion |

| Adjusted EBITDA margin* | Greater than or equal to 17% | Between 18% and 20% |

| Net cash flows from operating activities as a percentage of adjusted EBITDA* | Approximately 90% | Approximately 90% |

| Additions to property, equipment and intangible assets as a percentage of operating revenues* | Lower than or equal to 12% | Lower than 12% |

| Free cash flow margin* | Approximately 5% | Approximately 5% |

| Return on invested capital* | Not provided | Greater than or equal to 12% |

| Fully diluted share count | Lower than 300 million shares | Lower than 300 million shares |

*Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), adjusted EBITDA margin, net cash flows from operating activities as a percentage of adjusted EBITDA, additions to property, equipment and intangible assets as a percentage of operating revenues, free cash flow margin and return on invested capital are referred to in this news release. Such measures are non-GAAP financial measures, non-GAAP ratios, or supplementary financial measures, are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results.

The 2028 long-term targets and 2030 aspirations provided in this news release do not constitute guidance or outlook but rather are provided for the purpose of assisting the reader in measuring progress toward Air Canada’s objectives. The reader is cautioned that using this information for other purposes may be inappropriate. Air Canada may review and revise these targets and aspirations including as economic, geopolitical, market and regulatory environments change. These targets and aspirations are used as goals as Air Canada executes on its strategic priorities, and they assume a normal business environment. Air Canada’s ability to achieve these targets and aspirations is also dependent on its success in achieving initiatives and business objectives that are described in Air Canada’s 2024 Investor Day presentations, which are available at aircanada.com/investors, including those relating to increasing revenues, growing fleet and network capacity, and successfully executing on other key investments and initiatives, as well as other major assumptions, including those described in this news release, and are subject to a number of risks and uncertainties.

Non-GAAP Financial Measures

Below is a description of certain non-GAAP financial measures and ratios used by Air Canada to provide readers with additional information on its financial and operating performance. Such measures are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results. The non-GAAP financial measures or ratios described in this section typically have exclusions or adjustments that include one or more of the following characteristics, such as being highly variable, difficult to project, unusual in nature, significant to the results of a particular period or not indicative of past or future operating results. These items are excluded because the company believes these may distort the analysis of certain business trends and render comparative analysis across periods less meaningful and their exclusion generally allows for a more meaningful analysis of Air Canada’s operating expense performance and may allow for a more meaningful comparison to other airlines.

Air Canada excludes the effect of impairment of assets, if any, when calculating adjusted CASM, adjusted EBITDA, adjusted EBITDA margin, adjusted pre-tax income (loss) and adjusted net income (loss) as it may distort the analysis of certain business trends and render comparative analysis across periods or to other airlines less meaningful.

A charge of $34 million was recorded in the third quarter of 2024 in other operating expenses related to estimated costs associated with contractual lease obligations. Air Canada excluded this expense in computing adjusted CASM, adjusted EBITDA, adjusted pre-tax income and adjusted net income.

In the third quarter of 2025, Air Canada recorded a one-time pension past service cost and other labour related charges of $173 million, including from the pension plan amendments made in conjunction with the tentative agreement reached with CUPE. Air Canada has excluded this charge in computing its adjusted EBITDA, adjusted CASM, adjusted pre-tax income and adjusted net income.

Adjusted CASM

Air Canada uses adjusted CASM to assess the operating and cost performance of its ongoing airline business without the effects of aircraft fuel expense, the cost of ground packages at Air Canada Vacations, freighter costs and other items discussed above. These items may distort the analysis of certain business trends and render comparative analysis across periods less meaningful and their exclusion generally allows for a more meaningful analysis of Air Canada’s operating expense performance and may allow for a more meaningful comparison to that of other airlines.

In calculating adjusted CASM, aircraft fuel expense is excluded from operating expense results as it fluctuates widely depending on many factors, including international market conditions, geopolitical events, jet fuel refining costs and Canada/U.S. currency exchange rates. Air Canada also incurs expenses related to ground packages at Air Canada Vacations which some airlines, without comparable tour operator businesses, may not incur. In addition, these costs do not generate ASMs and therefore excluding these costs from operating expense results provides for a more meaningful comparison across periods when such costs may vary.

Air Canada also incurs expenses related to the operation of freighter aircraft which some airlines, without comparable cargo businesses, may not incur. Air Canada had six Boeing 767 dedicated freighter aircraft in service as at September 30, 2025, and September 30, 2024. These costs do not generate ASMs and therefore excluding these costs from operating expense results provides for a more meaningful comparison of the passenger airline business across periods.

The following tables provide the adjusted CASM reconciliation to GAAP operating expense for the periods indicated.

|

(Canadian dollars in millions, except where indicated) |

Third Quarter | First Nine Months | ||||||||||||||||

|

2025 |

2024 |

Change |

2025 |

2024 |

Change | |||||||||||||

| Operating expense – GAAP | $ | 5,490 | $ | 5,066 | $ | 424 | $ | 16,008 | $ | 15,334 | $ | 674 | ||||||

| Adjusted for: | ||||||||||||||||||

| Aircraft fuel | (1,212 | ) | (1,377 | ) | 165 | (3,546 | ) | (3,964 | ) | 418 | ||||||||

| Ground package costs | (103 | ) | (102 | ) | (1 | ) | (633 | ) | (574 | ) | (59 | ) | ||||||

| Freighter costs (excluding fuel) | (44 | ) | (40 | ) | (4 | ) | (128 | ) | (113 | ) | (15 | ) | ||||||

| Provision for contractual lease obligations | - | (34 | ) | 34 | - | (34 | ) | 34 | ||||||||||

| Pension plan amendments and other labor related charges | (173 | ) | - | (173 | ) | (173 | ) | (173 | ) | |||||||||

| Operating expense, adjusted for the above-noted items | $ | 3,958 | $ | 3,513 | $ | 445 | $ | 11,528 | 10,649 | 879 | ||||||||

| ASMs (millions) | 28,282 | 28,892 | (2.1 | ) % |

79,382 | 79,432 | % | |||||||||||

| Adjusted CASM (cents) | ¢ | 13.99 | ¢ | 12.15 | ¢ | 1.84 | ¢ | 14.52 | ¢ | 13.41 | ¢ | 1.11 | ||||||

|

(Canadian dollars in millions, except where indicated) |

Full Year | |||||

|

2024 |

2023 |

|||||

| Operating expense – GAAP | $ | 20,992 | $ | 19,554 | ||

| Adjusted for: | ||||||

| Aircraft fuel | (5,118 | ) | (5,318 | ) | ||

| Ground package costs | (782 | ) | (720 | ) | ||

| Freighter costs (excluding fuel) | (163 | ) | (157 | ) | ||

| Provision for contractual lease obligations | (34 | ) | - | |||

| Pension plan amendments | (490 | ) | - | |||

| Operating expense, adjusted for the above-noted items | 14,405 | 13,359 | ||||

| ASMs (millions) | 104,381 | 99,012 | ||||

| Adjusted CASM (cents) | ¢ | 13.80 | ¢ | 13.49 | ||

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA (earnings before interest, taxes, depreciation, amortization and impairment) and adjusted EBITDA margin (adjusted EBITDA as a percentage of operating revenues) are commonly used in the airline industry and are used by Air Canada as a means to view operating results and the related margin before interest, taxes, depreciation, amortization and impairment and other items discussed above. These items can vary significantly among airlines due to differences in the way airlines finance their aircraft and other assets.

Adjusted EBITDA and adjusted EBITDA margin are reconciled to GAAP operating income as follows:

| Third Quarter | First Nine Months | |||||||||||||

| (Canadian dollars in millions, except where indicated) | 2025 | 2024 | Change | 2025 | 2024 | Change | ||||||||

| Operating income – GAAP | $ | 284 | $ | 1,040 | $ | (756 | ) | $ | 594 | $ | 1,517 | $ | (923 | ) |

| Add back: | ||||||||||||||

| Depreciation, amortization and impairment | 504 | 449 | 55 | 1,490 | 1,339 | 151 | ||||||||

| Provision for contractual lease obligations | - | 34 | (34 | ) | - | 34 | (34 | ) | ||||||

| Pension plan amendments and other labour related charges | 173 | - | 173 | 173 | - | 173 | ||||||||

| Adjusted EBITDA | $ | 961 | $ | 1,523 | $ | (562 | ) | $ | 2,257 | $ | 2,890 | $ | (633 | ) |

| Operating revenues | $ | 5,774 | $ | 6,106 | $ | (332 | ) | $ | 16,602 | $ | 16,851 | $ | (249 | ) |

| Operating margin (%) | 4.9 | 17.0 | (12.1) pp | 3.6 | 9.0 | (5.4) pp | ||||||||

| Adjusted EBITDA margin (%) | 16.6 | 24.9 | (8.3) pp | 13.6 | 17.2 | (3.6) pp | ||||||||

Adjusted Pre-tax Income (Loss)

Adjusted pre-tax income (loss) is used by Air Canada to assess the overall pre-tax financial performance of its business without the effects of foreign exchange gains or losses, net interest relating to employee benefits, gains or losses on financial instruments recorded at fair value, gains or losses on sale and leaseback of assets, gains or losses on disposal of assets, gains or losses on debt settlements and modifications and other items discussed above. These items may distort the analysis of certain business trends and render comparative analysis across periods or to other airlines less meaningful.

A corporate charge for the settlement of tax matters related to the 2019 acquisition of Aeroplan $26 million was recorded in the first nine months of 2025. As this item is non-recurring and cash-neutral to Air Canada, since a related tax refund was also recorded, it has been excluded from adjusted pre-tax income.

Adjusted pre-tax income is reconciled to GAAP income before income taxes as follows:

| Third Quarter | First Nine Months | |||||||||||||||||

|

2025 |

2024 |

Change |

2025 |

2024 |

Change | |||||||||||||

| Income before income taxes – GAAP | $ | 511 | $ | 897 | $ | (386 | ) | $ | 447 | $ | 1,236 | $ | (789 | ) | ||||

| Adjusted for: | ||||||||||||||||||

| Provision for contractual lease obligations | - | 34 | (34 | ) | - | 34 | (34 | ) | ||||||||||

| Pension plan amendments and other labour related charges | 173 | - | 173 | 173 | - | 173 | ||||||||||||

| Foreign exchange (gain) loss | (343 | ) | 85 | (428 | ) | (142 | ) | 28 | (170 | ) | ||||||||

| Net interest relating to employee benefits | (4 | ) | (5 | ) | 1 | (14 | ) | (16 | ) | 2 | ||||||||

| Gain on financial instruments recorded at fair value | (16 | ) | (26 | ) | 10 | (76 | ) | (66 | ) | (10 | ) | |||||||

| Loss on debt settlements | - | - | - | - | 46 | (46 | ) | |||||||||||

| Other corporate expenses | 8 | - | 8 | 26 | - | 26 | ||||||||||||

| Adjusted pre-tax income | $ | 329 | $ | 985 | $ | (656 | ) | $ | 414 | $ | 1,262 | $ | (848 | ) | ||||

Adjusted Net Income (Loss) and Adjusted Earnings (Loss) Per Share – Diluted

Air Canada uses adjusted net income (loss) and adjusted earnings (loss) per share – diluted as a means to assess the overall financial performance of its business without the after-tax effects of foreign exchange gains or losses, net financing expense relating to employee benefits, gains or losses on financial instruments recorded at fair value, gains or losses on sale and leaseback of assets, gains or losses on debt settlements and modifications, gains or losses on disposal of assets and other items discussed above. These items may distort the analysis of certain business trends and render comparative analysis to other airlines less meaningful.

A corporate charge for the settlement of tax matters related to the 2019 acquisition of Aeroplan $26 million was recorded in the first nine months of 2025. As this item is non-recurring and cash-neutral to Air Canada, since a related tax refund was also recorded, it has been excluded from adjusted pre-tax income.

Adjusted net income and adjusted earnings per share – diluted are reconciled to GAAP net income as follows:

| Third Quarter | First Nine Months | |||||||||||||||||

|

2025 |

2024 |

Change |

2025 |

2024 |

Change | |||||||||||||

| Net income – GAAP | $ | 264 | $ | 2,035 | $ | (1,771 | ) | $ | 348 | $ | 2,364 | $ | (2,016 | ) | ||||

| Adjusted for: | ||||||||||||||||||

| Provision for contractual lease obligations | - | 34 | (34 | ) | - | 34 | (34 | ) | ||||||||||

| Pension plan amendments and other labour related charges | 173 | - | 173 | 173 | - | 173 | ||||||||||||

| Foreign exchange (gain) loss | (343 | ) | 85 | (428 | ) | (142 | ) | 28 | (170 | ) | ||||||||

| Net interest relating to employee benefits | (4 | ) | (5 | ) | 1 | (14 | ) | (16 | ) | 2 | ||||||||

| Gain on financial instruments recorded at fair value | (16 | ) | (26 | ) | 10 | (76 | ) | (66 | ) | (10 | ) | |||||||

| Loss on debt settlements | - | - | - | - | 46 | (46 | ) | |||||||||||

| Other corporate expenses | 8 | - | 8 | 26 | - | 26 | ||||||||||||

| Income tax, including for the above reconciling items | 141 | (1,154 | ) | 1,295 | (35 | ) | (1,148 | ) | 1,113 | |||||||||

| Adjusted net income | $ | 223 | $ | 969 | $ | (746 | ) | $ | 280 | $ | 1,242 | $ | (962 | ) | ||||

| Weighted average number of outstanding shares used in computing diluted income per share (in millions) | 297 | 376 | (79 | ) | 328 | 376 | (48 | ) | ||||||||||

| Adjusted earnings per share – diluted | $ | 0.75 | $ | 2.57 | $ | (1.82 | ) | $ | 0.85 | $ | 3.30 | $ | (2.45 | ) | ||||

The table below reflects the share amounts used in the computation of basic and diluted earnings per share on an adjusted earnings per share basis:

|

(In millions) |

Third Quarter | First Nine Months | ||

| 2025 | 2024 | 2025 | 2024 | |

| Weighted average number of shares outstanding – basic | 296 | 358 | 316 | 358 |

| Effect of dilution | 1 | 18 | 12 | 18 |

| Weighted average number of shares outstanding – diluted | 297 | 376 | 328 | 376 |

Free Cash Flow

Air Canada uses free cash flow as an indicator of the financial strength and performance of its business, indicating the amount of cash Air Canada can generate from operations and after capital expenditures. Free cash flow is calculated as net cash flows from operating activities minus additions to property, equipment, and intangible assets, and is net of proceeds from sale and leaseback transactions.

The table below reconciles free cash flow to net cash flows from (used in) operating activities for the periods indicated.

| Third Quarter | First Nine Months | |||||||||||||||||

| (Canadian dollars in millions) |

2025 |

2024 |

$ Change |

2025 |

2024 |

$ Change | ||||||||||||

| Net cash flows from operating activities | $ | 813 | $ | 737 | $ | 76 | $ | 3,234 | $ | 3,253 | $ | (19 | ) | |||||

| Additions to property, equipment, and intangible assets | (602 | ) | (455 | ) | (147 | ) | (2,009 | ) | (1,464 | ) | (545 | ) | ||||||

| Free cash flow | $ | 211 | $ | 282 | $ | (71 | ) | $ | 1,225 | $ | 1,789 | $ | (564 | ) | ||||

Net Debt

Net debt is a capital management measure and a key component of the capital managed by Air Canada and provides management with a measure of its net indebtedness.

Net Debt to Trailing 12-Month Adjusted EBITDA (Leverage Ratio)

Net debt to trailing 12-month adjusted EBITDA ratio (also referred to as “leverage ratio”) is commonly used in the airline industry and is used by Air Canada as a means to measure financial leverage. Leverage ratio is calculated by dividing net debt by trailing 12-month adjusted EBITDA.

The table below reconciles leverage ratio to Air Canada’s net debt balances as at the dates indicated.

| (Canadian dollars in millions) | September 30, 2025 | December 31, 2024 | September 30, 2024 | ||||||

| Total long-term debt and lease liabilities | $ | 8,699 | $ | 10,915 | $ | 10,716 | |||

| Current portion of long-term debt and lease liabilities | 3,070 | 1,755 | 1,652 | ||||||

| Total long-term debt and lease liabilities (including current portion) | 11,769 | 12,670 | 12,368 | ||||||

| Less cash, cash equivalents and short- and long-term investments | (6,939 | ) | (7,752 | ) | (8,942 | ) | |||

| Net debt | $ | 4,830 | $ | 4,918 | $ | 3,426 | |||

| Adjusted EBITDA (trailing 12 months) | $ | 2,953 | 3,586 | $ | 3,411 | ||||

| Net debt to adjusted EBITDA ratio | 1.6 | 1.4 | 1.0 | ||||||

The tables below present comparative figures for the twelve-month periods ending December 31, 2023 and 2024, in reference to Air Canada's full-year 2025 guidance, 2028 financial targets, and 2030 aspirations.

| (Canadian dollars in millions, except where indicated) | 2024 Results | 2023 Results |

| ASM Capacity | 104.381 billion | 99.012 billion |

| Adjusted CASM (cents) | 13.80¢ | 13.49¢ |

| Operating expenses | $20.992 billion | $19.554 billion |

| Adjusted EBITDA | $3.586 billion | $3.982 billion |

| Operating income | $1.263 billion | $2.279 billion |

| Free cash flow | $1.294 billion | $2.756 billion |

| Net cash flows from operating activities | $3.930 billion | $4.320 billion |

| (Canadian dollars in millions, except where indicated) | 20241 | 20231 |

| Operating revenues | $22.255 billion | $21.833 billion |

| Adjusted EBITDA margin | 16% | 18% |

| Operating margin | 6% | 10% |

| Net cash flows from operating activities as a percentage of adjusted EBITDA | 110% | 108% |

| Additions to property, equipment and intangible assets as a percentage of operating revenues | 12% | 7% |

| Free cash flow margin | 6% | 13% |

| Return on invested capital | 14% | 18% |

| Income before income taxes | $515 million | $2.212 billion |

| Fully diluted share count | Approximately 376 million shares | Approximately 376 million shares |

1Percentage amounts in the table above may not calculate exactly due to rounding.

The 2028 long-term targets and 2030 aspirations provided in this news release do not constitute guidance or outlook but rather are provided for the purpose of assisting the reader in measuring progress toward Air Canada’s objectives. The reader is cautioned that using this information for other purposes may be inappropriate. Air Canada may review and revise these targets and aspirations including as economic, geopolitical, market and regulatory environments change. These targets and aspirations are used as goals as Air Canada executes on its strategic priorities, and they assume a normal business environment. Air Canada’s ability to achieve these targets and aspirations is also dependent on its success in achieving initiatives and business objectives that are described in Air Canada’s 2024 Investor Day presentations, which are available at aircanada.com/investors, including those relating to increasing revenues, growing fleet and network capacity, and successfully executing on other key investments and initiatives, as well as other major assumptions, including those described in this news release, and are subject to a number of risks and uncertainties.

Net cash flows from operating activities as a percentage of adjusted EBITDA

Air Canada uses net cash flows from operating activities as a percentage of adjusted EBITDA to measure cash conversion from adjusted EBITDA. This measure is defined as the ratio of net cash flows from operating activities to adjusted EBITDA.

Additions to property, equipment and intangible assets as a percentage of operating revenues

Air Canada uses additions to property, equipment and intangible assets as a percentage of operating revenues to measure the proportion of operating revenues that are reinvested as capital expenditures. This measure is defined as the ratio of additions to property, equipment and intangible assets to operating revenues.

Free cash flow margin

Air Canada uses free cash flow margin to measure the amount its free cash flow represents as a percentage of operating revenues. This measure is defined as the ratio of free cash flow to operating revenues.

The table below presents the quantitative reconciliation for adjusted EBITDA, adjusted EBITDA margin, net cash flows from operating activities as a percentage of adjusted EBITDA, additions to property, equipment and intangible assets as a percentage of operating revenues, free cash flow and free cash flow margin, in each case for the financial years ended December 31, 2024 and 2023.

| (in millions, except where indicated) |

2024 |

2023 |

||||

| Total operating revenues – GAAP | $ | 22,255 | $ | 21,833 | ||

| Operating income – GAAP | $ | 1,263 | $ | 2,279 | ||

| Add back: | ||||||

| Depreciation and amortization | 1,799 | 1,703 | ||||

| EBITDA | 3,062 | 3,982 | ||||

| Add back: | ||||||

| Provision for contractual lease obligations | 34 | - | ||||

| Pension plan amendments | 490 | - | ||||

| Adjusted EBITDA | $ | 3,586 | $ | 3,982 | ||

| Net cash flows from operating activities | $ | 3,930 | $ | 4,320 | ||

| Additions to property, equipment and intangible assets | (2,636 | ) | (1,564 | ) | ||

| Free cash flow | $ | 1,294 | $ | 2,756 | ||

| Operating margin | 6% | 10% | ||||

| Adjusted EBITDA margin | 16% | 18% | ||||

| Net cash flows from operating activities as a percentage of adjusted EBITDA | 110% | 108% | ||||

| Additions to property, equipment and intangible assets as a percentage of operating revenues | 12% | 7% | ||||

| Free cash flow margin | 6% | 13% | ||||

Return on invested capital

Air Canada uses return on invested capital (ROIC) to assess the efficiency with which it allocates its capital to generate returns. ROIC is calculated as the ratio of adjusted pre-tax income (loss), excluding interest expense, to invested capital. Invested capital includes average year-over-year long-term debt and lease obligations, average year-over-year shareholders' equity, and the embedded derivative on Air Canada's convertible notes. In 2020, Air Canada issued convertible unsecured notes. Air Canada had the option to deliver cash or a combination of cash and shares on the conversion date in lieu of shares, giving rise to an embedded derivative that was included as part of the definition of capital. Air Canada calculates invested capital on a book value-based method when calculating ROIC.

Return on invested capital is reconciled to GAAP income (loss) before income taxes as follows:

| (in millions, except where indicated) |

2024 |

2023 |

||||

| Income before income taxes – GAAP | $ | 515 | $ | 2,212 | ||

| Adjusted for: | ||||||

| Provision for contractual lease obligations | 34 | - | ||||

| Pension plan amendments | 490 | - | ||||

| Foreign exchange (gain) loss | 400 | (389 | ) | |||

| Net interest relating to employee benefits | (22 | ) | (25 | ) | ||

| (Gain) on financial instruments recorded at fair value | (28 | ) | (115 | ) | ||

| Loss on debt settlements and modifications | 8 | 10 | ||||

| Adjusted pre-tax income | $ | 1,397 | $ | 1,693 | ||

| Add back: | ||||||

| Interest expense | 763 | 944 | ||||

| Adjusted pre-tax income before interest expense | $ | 2,160 | $ | 2,637 | ||

| Invested capital: | ||||||

| Average long-term debt and lease liabilities (including current portion) | 13,266 | 15,084 | ||||

| Embedded derivative on convertible notes | 45 | 56 | ||||

| Average shareholders’ equity (deficiency) | 1,592 | (380 | ) | |||

| Invested capital | $ | 14,903 | $ | 14,761 | ||

| Return on invested capital (%) | 14% | 18% | ||||

Third Quarter 2025 Conference Call

Air Canada will host its quarterly analysts’ call on Wednesday, November 5, 2025, at 8:00 a.m. ET. Michael Rousseau, President and Chief Executive Officer, John Di Bert, Executive Vice President and Chief Financial Officer, and Mark Galardo, Executive Vice President and Chief Commercial Officer and President, Cargo, will present the results and be available for analysts' questions. Immediately following the analysts' Q&A session, Mr. Di Bert and Pierre Houle, Vice President and Treasurer, will be available to answer questions from term loan B lenders and holders of Air Canada bonds.

| Media and the public may access this call on a listen-in basis. Details are as follows: | |

| Webcast: | https://edge.media-server.com/mmc/p/79jny438 |

| By telephone: | 647-932-3411 or 1-800-715-9871 (toll-free) |

| Conference ID 8572108 | |

| Please allow 10 minutes to be connected to the conference call. | |

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release includes forward-looking statements within the meaning of applicable securities laws. Forward-looking statements relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These statements may involve, but are not limited to, comments relating to guidance, strategies, expectations, planned operations or future actions. Forward-looking statements are identified using terms and phrases such as "preliminary"; "anticipate"; "believe"; "could"; "estimate"; "expect"; "intend"; "may"; "plan"; "predict"; "project"; "will"; "would"; and similar terms and phrases, including references to assumptions.

Forward-looking statements, by their nature, are based on assumptions including those described herein and are subject to important risks and uncertainties, which are amplified in the current environment. Forward-looking statements cannot be relied upon due to, among other things, changing external events and general uncertainties of the business of Air Canada. Actual results may differ materially from results indicated in forward-looking statements due to a number of factors, including those discussed below.

Factors that may cause results to differ materially from results indicated in forward-looking statements include economic conditions, statements or actions by governments and uncertainty relating to the imposition of (or threats to impose) tariffs on Canadian exports or imports and their resulting impacts on the Canadian, North American and global economies and travel demand, geopolitical conditions such as the military conflicts in the Middle East and between Russia and Ukraine, Air Canada’s ability to successfully achieve or sustain positive net profitability, industry and market conditions and the demand environment, competition, Air Canada’s dependence on technology, cybersecurity risks, interruptions of service, climate change and environmental factors (including weather systems and other natural phenomena and factors arising from anthropogenic sources), Air Canada’s dependence on key suppliers (including government agencies and other stakeholders supporting airport and airline operations), employee and labour relations and costs, Air Canada’s ability to successfully implement appropriate strategic and other important initiatives (including Air Canada’s ability to manage operating costs), energy prices, Air Canada’s ability to pay its indebtedness and maintain or increase liquidity, Air Canada’s dependence on regional and other carriers, Air Canada’s ability to attract and retain required personnel, epidemic diseases, changes in laws, regulatory developments or proceedings, terrorist acts, war, Air Canada’s ability to successfully operate its loyalty program, casualty losses, Air Canada’s dependence on Star Alliance® and joint ventures, Air Canada’s ability to preserve and grow its brand, pending and future litigation and actions by third parties, currency exchange fluctuations, limitations due to restrictive covenants, insurance issues and costs, and pension plan obligations as well as the factors identified in Air Canada’s public disclosure file available at www.sedarplus.ca and, in particular, those identified in section 18 “Risk Factors” of Air Canada’s 2024 MD&A and in section 14 “Risk Factors” of Air Canada’s Third Quarter 2025 MD&A.

Air Canada has and continues to establish targets, make commitments and assess the impact regarding climate change, and related initiatives, plans and proposals that Air Canada and other stakeholders (including government, regulatory and other bodies) are pursuing in relation to climate change and carbon emissions. The achievement of our commitments and targets depends on many factors, including the combined actions of governments, industry, suppliers and other stakeholders and actors, as well as the development and implementation of new technologies. In particular, our 2030 carbon emission-related targets and our related 2050 aspiration are ambitious and heavily dependent on new technologies, renewable energies and the availability of a sufficient supply of sustainable aviation fuels (SAF), which continues to present serious challenges. In addition, Air Canada has incurred, and expects to continue to incur, costs to achieve its goal of net-zero carbon emissions and to comply with environmental sustainability legislation and regulation and other standards and accords. The precise nature of future binding or non-binding legislation, regulation, standards and accords, on which local and international stakeholders are increasingly focusing, cannot be predicted with any degree of certainty, nor can their financial, operational or other impact. There can be no assurance of the extent to which any of our climate goals will be achieved or that any future investments that we make in furtherance of achieving our climate goals will produce the expected results or meet increasing stakeholder environmental, social and governance expectations. Moreover, future events could lead Air Canada to prioritize other nearer-term interests over progressing toward our current climate goals based on business strategy, economic, regulatory and social factors, and potential pressure from investors, activist groups or other stakeholders. If we are unable to meet or properly report on our progress toward achieving our climate change goals and commitments, we could face adverse publicity and reactions from investors, customers, advocacy groups or other stakeholders, which could result in reputational harm or other adverse effects to Air Canada.

The forward-looking statements contained or incorporated by reference in this news release represent Air Canada's expectations as of the date of this news release (or as of the date they are otherwise stated to be made) and are subject to change after such date. However, Air Canada disclaims any intention or obligation to update or revise any forward-looking statements whether because of new information, future events or otherwise, except as required under applicable securities regulations.

| Contacts: | media@aircanada.ca |

| Internet: |

aircanada.com/media |

Read our annual report Here

Sign up for Air Canada news: aircanada.com

Selected Financial Metrics and Statistics

The financial and operating highlights for Air Canada for the periods indicated are as follows:

| (Canadian dollars in millions, except per share figures or where indicated) | Third Quarter | First Nine Months | |||||

| Financial Performance Metrics |

2025 |

2024 |

$ Change |

2025 |

2024 |

$ Change | |

| Operating revenues | 5,774 | 6,106 | (332) | 16,602 | 16,851 | (249) | |

| Operating income | 284 | 1,040 | (756) | 594 | 1,517 | (923) | |

| Operating margin (1) (%) | 4.9 | 17.0 | (12.1) pp (8) | 3.6 | 9.0 | (5.4) pp | |

| Adjusted EBITDA (2) | 961 | 1,523 | (562) | 2,257 | 2,890 | (633) | |

| Adjusted EBITDA margin (2) (%) | 16.6 | 24.9 | (8.3) pp | 13.6 | 17.2 | (3.6) pp | |

| Income before income taxes | 511 | 897 | (386) | 447 | 1,236 | (789) | |

| Net income | 264 | 2,035 | (1,771) | 348 | 2,364 | (2,016) | |

| Adjusted pre-tax income (2) | 329 | 985 | (656) | 414 | 1,262 | (848) | |

| Adjusted net income (2) | 223 | 969 | (746) | 280 | 1,242 | (962) | |

| Total liquidity (3) | 8,296 | 10,261 | (1,965) | 8,296 | 10,261 | (1,965) | |

| Net cash flows from operating activities | 813 | 737 | 76 | 3,234 | 3,253 | (19) | |

| Free cash flow (2) | 211 | 282 | (71) | 1,225 | 1,789 | (564) | |

| Net debt (2) | 4,830 | 3,426 | 1,404 | 4,830 | 3,426 | 1,404 | |

| Long-term debt and lease liabilities | 11,769 | 12,368 | (599) | 11,769 | 12,368 | (599) | |

| Diluted earnings per share | 0.88 | 5.38 | (4.50) | 0.90 | 6.25 | (5.35) | |

| Adjusted earnings per share – diluted (2) | 0.75 | 2.57 | (1.82) | 0.85 | 3.30 | (2.45) | |

| Operating Statistics (4) |

2025 |

2024 |

% Change |

2025 |

2024 |

% Change | |

| Revenue passenger miles (RPMs) (millions) | 24,459 | 25,101 | (2.6) | 67,142 | 68,070 | (1.4) | |

| Available seat miles (ASMs) (millions) | 28,282 | 28,892 | (2.1) | 79,382 | 79,432 | (0.1) | |

| Passenger load factor % | 86.5% | 86.9% | (0.4) pp | 84.6% | 85.7% | (1.1) pp | |

| Passenger revenue per RPM (Yield) (cents) | 21.4 | 22.3 | (3.9) | 21.8 | 22.1 | (1.5) | |

| Passenger revenue per ASM (PRASM) (cents) | 18.5 | 19.4 | (4.4) | 18.4 | 18.9 | (2.8) | |

| Operating revenue per ASM (TRASM) (cents) | 20.4 | 21.1 | (3.4) | 20.9 | 21.2 | (1.4) | |

| Operating expense per ASM (CASM) (cents) | 19.4 | 17.5 | 10.7 | 20.2 | 19.3 | 4.5 | |

| Adjusted CASM (cents) (2) | 14.0 | 12.2 | 15.1 | 14.5 | 13.4 | 8.3 | |

| Average number of full-time-equivalent (FTE) employees (thousands) (5) | 37.0 | 37.2 | (0.5) | 37.2 | 37.1 | 0.2 | |

| Aircraft in operating fleet at period-end | 366 | 353 | 3.7 | 366 | 353 | 3.7 | |

| Seats dispatched (thousands) | 15,095 | 15,258 | (1.1) | 42,912 | 42,950 | (0.1) | |

| Aircraft frequencies (thousands) | 102.8 | 104.5 | (1.6) | 292.7 | 293.4 | (0.2) | |

| Average stage length (miles) (6) | 1,874 | 1,894 | (1.1) | 1,850 | 1,849 | 0.0 | |

| Fuel cost per litre (cents) | 88.3 | 98.2 | (10.1) | 91.3 | 102.5 | (10.9) | |

| Fuel litres (thousands) | 1,356,485 | 1,399,170 | (3.1) | 3,819,892 | 3,857,355 | (1.0) | |

| Revenue passengers carried (thousands) (7) | 12,168 | 12,618 | (3.6) | 34,102 | 34,957 | (2.4) | |

| (1) | Operating margin is a supplementary financial measure and is defined as operating income (loss) as a percentage of operating revenues. |

| (2) | Adjusted pre-tax income (loss), adjusted net income (loss), adjusted earnings (loss) per share, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), adjusted EBITDA margin, free cash flow, net debt and adjusted CASM are non-GAAP financial measures, capital management measures, non-GAAP ratios or supplementary financial measures. Such measures are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results. Refer to section “Non-GAAP Financial Measures” of this release for descriptions of Air Canada’s non-GAAP financial measures and for a quantitative reconciliation of Air Canada’s non-GAAP financial measures to the most comparable GAAP measure. |

| (3) | Total liquidity refers to the sum of cash, cash equivalents, short and long-term investments, and the amounts available under Air Canada’s credit facilities. Total liquidity, as at September 30, 2025, of $8,296 million consisted of $6,939 million in cash, cash equivalents, short- and long-term investments and $1,357 million available under undrawn credit facilities. As at September 30, 2024, total liquidity of $10,261 million consisted of $8,942 million in cash, cash equivalents, short- and long-term investments and $1,319 million available under undrawn credit facilities. These amounts also include funds ($278 million as at September 30, 2025, and $243 million as at September 30, 2024) held in trust by Air Canada Vacations in accordance with regulatory requirements governing advance sales for tour operators. |

| (4) | Except for the reference to average number of full-time equivalent (FTE) employees, operating statistics in this table include third party carriers operating under capacity purchase agreements with Air Canada. |

| (5) | Reflects FTE employees at Air Canada and its subsidiaries. Excludes FTE employees at third-party carriers operating under capacity purchase agreements with Air Canada. |

| (6) | Average stage length is calculated by dividing the total number of available seat miles by the total number of seats dispatched. |

| (7) | Revenue passengers are counted on a flight number basis (rather than by journey/itinerary or by leg), which is consistent with the IATA definition of revenue passengers carried. |

| (8) | Percentage point, or “pp”, is a measure of the arithmetic / absolute difference between two percentages. |

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ad63f1e1-21c1-46ae-bf67-43d96930147a

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.